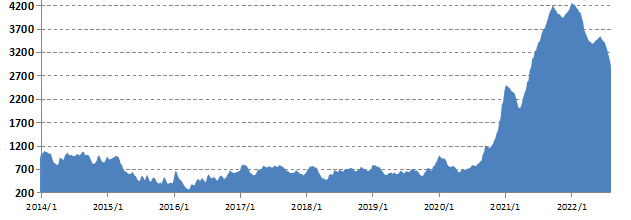

Industry insiders pointed out that inflation, epidemic control, and the increase of new ships, leading to the increase of shipping space and the decrease of cargo volume, are the three key factors for freight rates to continue to explore against the trend in the traditional peak season.

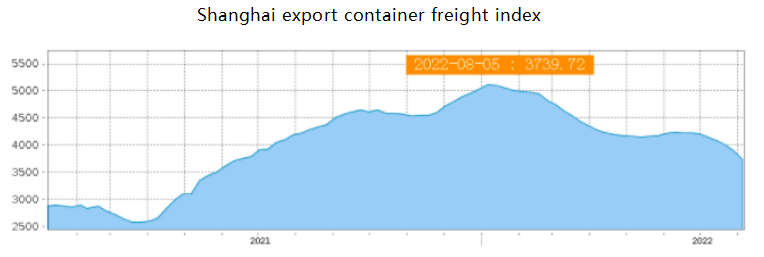

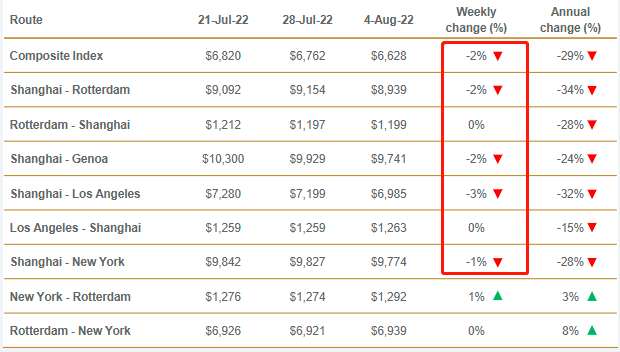

1. Container freight rates have fallen for eight consecutive years

The Shanghai Shipping Exchange announced that the latest SCFI index continued to drop 148.13 points to 3739.72 points, down 3.81%, falling for eight consecutive weeks. Rewriting the new low since the middle of June last year, the four long-distance routes fell synchronously, among which the European route and the US western route fell more, with the weekly drop of 4.61% and 12.60% respectively.

The latest SCFI index shows:

- the freight rate of each case from Shanghai to Europe was US $5166, down US $250 this week, down 3.81%;

- the Mediterranean line was $5971 per box, down $119 this week, down 1.99%;

- the freight rate of each 40 foot container in West America was US $6499, down US $195 this week, down 2.91%;

- the freight rate of each 40 foot container in East America was US $9330, down US $18 this week, down 0.19%;

- the freight rate of South America Line (Santos) is US $9531 per case, up US $92 per week, or 0.97%;

- the freight rate of the Persian Gulf route is US $2601 / TEU, down 6.7% from the previous period;

- the freight rate of the Southeast Asia line (Singapore) was US $846 per case, down US $122 this week, or 12.60%.

The Drury world container freight index (WCI) fell for 22 consecutive weeks, with a 2% drop, which was again expanded compared with the past two weeks.

Ningbo Shipping Exchange released that the latest ncfi index closed at 2912.4, down 4.1% from last week.

Among the 21 routes, the freight rate index of one route increased, and the freight rate index of 20 routes decreased. Among the major ports along the "maritime Silk Road", one port's freight rate index rose and 15 port's freight rate index fell.

Key route indexes are as follows:

Europe land route: Europe land route maintains the situation of supply exceeding demand, and the market freight rate continues to fall, and the decline has expanded.

North America route: the freight rate index of the US east route was 3207.5 points, down 0.5% from last week; The freight rate index of the US west route was 3535.7 points, down 5.0% from last week.

Middle East Route: the middle east route index was 1988.9 points, down 9.8% from last week.

Analysts believe that with the stabilization of the epidemic prevention and control situation, it is reasonable for international shipping prices to fall steadily this year. The recent rapid decline is caused by factors such as the improvement of shipping efficiency, the decline of domestic and foreign demand, the fall of international oil prices, and the steady increase of transportation capacity.

2. Port congestion is still serious

In addition, port congestion still exists. In May and June, European ports were congested, and the congestion on the west coast of the United States was not significantly alleviated.

As of June 30, 36.2% of the world's container ships were stranded in ports due to workers' strikes, high summer temperatures and other factors. The supply chain was blocked and the transportation capacity was limited, which formed a certain support for the freight rate in the short term. Although the spot freight rate has declined, it is still at a high level.

The container capacity of the trade routes from the Far East to the United States continues to shift from west to East, and the number of containers handled by the ports on the east coast of the United States has increased this year. This shift has led to congestion in ports on the east coast.

George Griffiths, editor in chief of global container freight of S & P global commodities, said that the ports on the east coast are still congested, and the port of Savannah is under the pressure of a large number of cargo imports and ship delays.

However, due to the protest activities of truck drivers in the west of the United States, the port is still blocked, and some cargo owners turn their goods to the east of the United States. The bottleneck in the supply chain still helps to maintain the freight rate at a relatively high level.

According to the survey of American shipper on maritime traffic and queuing ship data, in late July, the number of ships waiting in North American ports exceeded 150. This figure fluctuates every day and is now 15% lower than the peak, but it is still at an all-time high.

As of the morning of August 8, a total of 130 ships were waiting outside the port, of which 71% were on the east coast and the Gulf Coast, and 29% were on the west coast.

According to the data, there are 19 ships waiting for berthing outside the New York New Jersey Port, while the number of ships waiting for berthing in the Savannah port has surged to more than 40. These two ports are the first and second largest ports on the east coast.

Compared with the peak period, the congestion in the western port of the United States has eased, and the rate of punctuality has also increased, reaching the highest level (24.8%) in more than a year. In addition, the average delay time of ships is 9.9 days, which is higher than that of the east coast.

Patrick Jany, chief financial officer of Maersk, said that freight rates may decline in the coming months. When the downward trend of freight rates stops, it will stabilize at a higher level than before the epidemic.

Detlef trefzger, CEO of Dexun, predicted that the freight rate would eventually stabilize at the level of 2 to 3 times before the outbreak.

Mason's Cox said that spot freight rates are being adjusted slowly and orderly, and there will be no precipitous drop. Liner companies will continue to invest all or nearly all of their capacity on the route.

Post time: Aug-15-2022